Key Points

- Accel report finds U.S. leads in large AI models but Europe closing the gap in applications.

- European and Israeli AI app startups have raised 66 cents for every dollar raised by U.S. peers.

- Lovable and Synthesia are highlighted as emerging category leaders in the AI app layer.

- AI‑native applications are reaching $100 million ARR in just a few years, a speed previously unseen.

- Revenue per headcount is now the highest ever recorded for software companies.

- Public cloud index up 25% year‑over‑year, with firms adding agentic capabilities.

- Doctolib cited as a private AI‑native company backed by Accel.

- European model firms like Mistral AI face a less target‑rich environment, according to Accel.

- VCs see defensibility in fast‑adopting product offerings and believe data remains undervalued.

Market Landscape

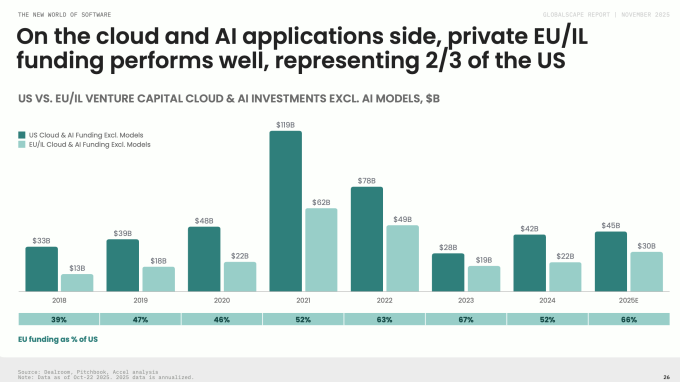

The Accel 2025 Globalscape report, focused on AI and cloud, confirms that the United States maintains a clear lead in the development of large AI models. However, the competitive picture shifts when looking at the application layer, where European and Israeli startups are gaining ground. According to the report, European and Israeli cloud and AI application companies have raised 66 cents for every dollar raised by their American counterparts.

Emerging Category Leaders

The report spotlights several fast‑growing firms that illustrate the shift. Lovable, described as a “vibe‑coding” startup, and Synthesia, which provides AI‑generated video for enterprises, are cited as emerging category leaders. Both companies are also Accel portfolio investments, underscoring the firm’s confidence in their market potential.

Growth Velocity and Efficiency

Accel partner Philippe Botteri notes that the growth velocity of today’s AI‑native applications far exceeds that of previous waves. Companies are reaching $100 million in annual recurring revenue within a few years—a milestone that previously required decades. Botterri adds that revenue per headcount is now the highest ever seen in software, reflecting an unprecedented level of efficiency.

Investment Landscape

Despite the surge in application‑layer activity, existing public cloud software firms remain strong, with the Public Cloud Index up 25% year‑over‑year. Botteri observes that many of these firms are adding agentic capabilities to their products. Private companies are also integrating AI deeply enough to be considered AI‑native; Doctolib, an Accel portfolio company, is given as an example.

European Model Companies

While Europe harbors high hopes for homegrown foundation‑model companies such as Mistral AI, the report takes a cautious view. Botteri suggests that the environment is not “very target‑rich” for large models, though he does not rule out future breakthroughs for smaller models.

VC Perspectives on Defensibility and Data

Venture capitalists remain active in the AI application space, despite recurring questions about defensibility. Botteri argues that product‑centric offerings with rapid adoption still provide defensible positions. Lotan Levkowitz of Grove Ventures adds that data is currently undervalued, emphasizing the lucrative potential of companies that build proprietary data flywheels.

Source: techcrunch.com