Key Points

- Data centers projected to draw 106 GW by 2035, nearly triple current demand.

- Average new facility expected to exceed 100 MW, with many sites over 500 MW.

- Utilization rates to rise from 59 % to 69 % as AI workloads grow.

- Global investment in data‑center construction reached $580 billion this year.

- Early‑stage projects more than doubled between early 2024 and early 2025.

- New capacity planned primarily in PJM states and Texas’s ERCOT grid.

- Regulatory complaint filed with FERC urging PJM to enforce load‑queue rules.

- Data centers identified as a factor in rising regional electricity prices.

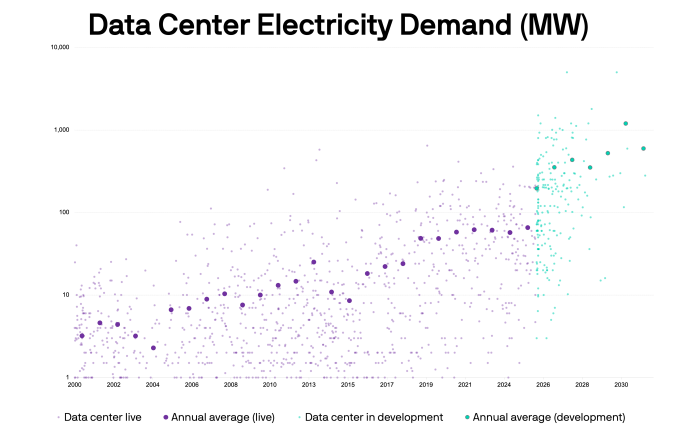

A chart illustrating data center electricity use through 2032.

Rising Energy Demand

Planned data‑center construction shows no signs of fading, with new additions expected to require 2.7 ×—nearly triple—the sector’s current demand for electricity over the next decade, according to BloombergNEF. By 2035, data centers are projected to draw 106 GW, up sharply from the 40 GW they use today. The report highlights that the average new facility will draw well over 100 MW, a stark increase from today’s landscape where only 10 % of data centers draw more than 50 MW.

Nearly a quarter of upcoming sites will be larger than 500 MW, and a few will exceed 1 GW, skewing overall demand upward. Utilization rates are also set to rise from 59 % to 69 % as AI training and inference workloads grow to nearly 40 % of total data‑center compute.

AI Driving Growth

AI companies are racing to build more powerful data centers, fueling a surge in global investment that reached $580 billion this year. This investment outpaces the world’s spending on new oil supplies, underscoring the strategic importance of compute capacity for AI development. Early‑stage projects have more than doubled between early 2024 and early 2025, reflecting the rapid pace of announcements and commitments.

Geographic Shift to Rural Areas

Much of the new capacity is being planned for locations such as Virginia, Pennsylvania, Ohio, Illinois and New Jersey, all within the PJM Interconnection—a regional transmission organization that oversees the electric grid in those states and others. Texas’s ERCOT grid will also see a large number of additions. The shift toward more rural sites is driven by scarcity of suitable land near urban centers, prompting developers to look farther afield for large‑scale facilities.

Regulatory Scrutiny and Grid Reliability

The PJM Interconnection is under scrutiny after a complaint was filed with the Federal Energy Regulatory Commission. The complaint argues that PJM has the authority to require new data‑center loads to wait until the grid can reliably serve them, and that failure to enforce these rules is contributing to high electricity prices in the region. PJM’s ability to create a load queue is highlighted as a tool to protect reliability and affordability.

Overall, the report paints a picture of an industry on the cusp of massive expansion, driven by AI demand, larger facilities and a strategic shift to less congested grid areas, while also facing heightened regulatory attention to ensure grid stability and reasonable pricing.

Source: techcrunch.com